Why Agentic Commerce Needs Crypto to Scale

July 2, 2025

by Dan Kim, Nemil Dalal

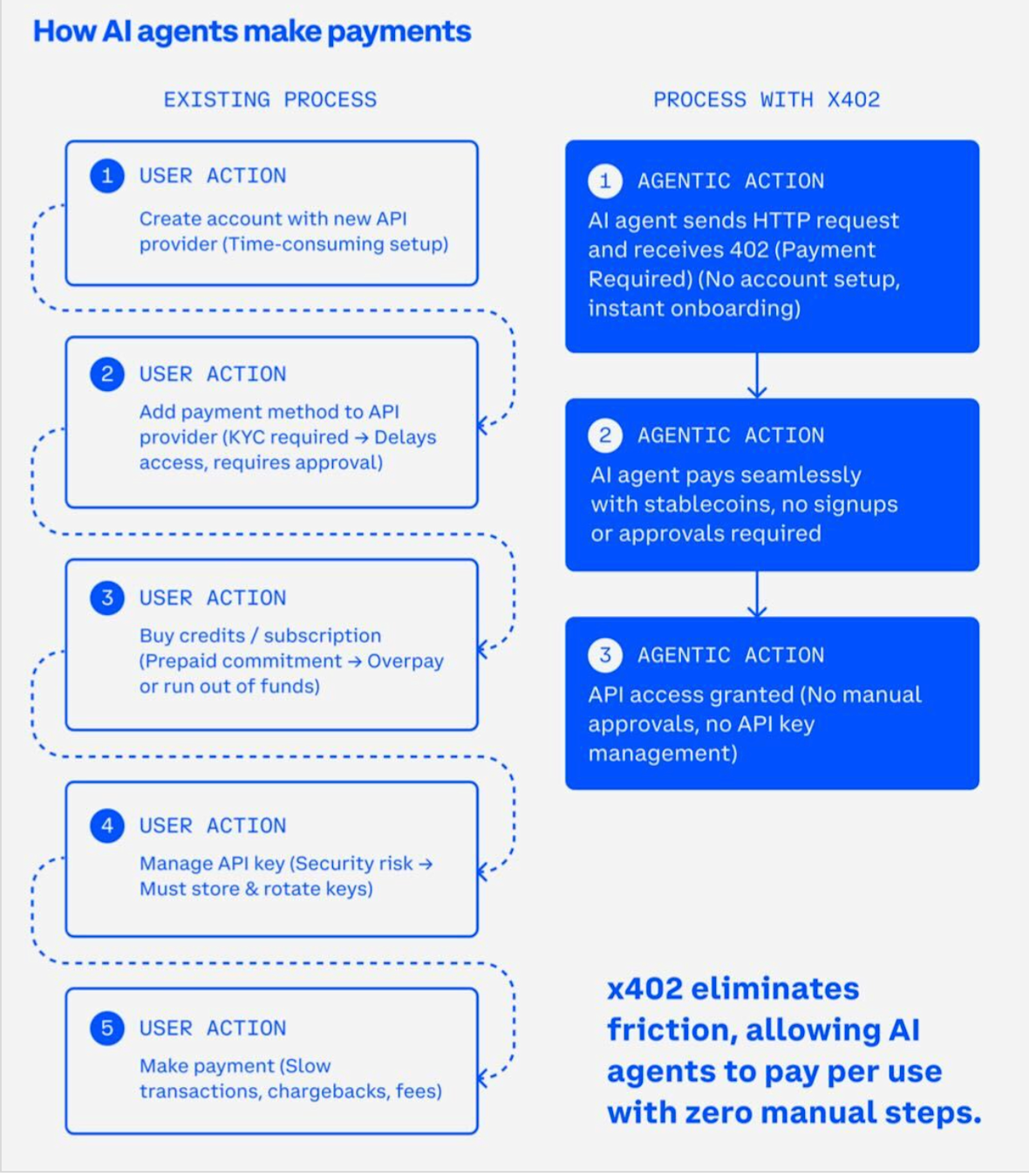

TL;DR: As AI agents become the dominant participants in digital commerce, today’s human-centric payment infrastructure is falling behind. This post explains why crypto-native rails are the only viable path to support real-time, autonomous, and scalable agentic payments.

E-commerce is changing everywhere.

The long-dominant ad-supported internet model is giving way to usage-based economics, as AI agents increasingly act on behalf of users and systems to directly pay for data, content, and services.

AI agents aren’t just assisting anymore — they’re transacting. Buying, selling, fetching data, and coordinating services in real time.

But while commerce has changed, payments haven’t. Today’s systems were built for humans — with borders, logins, and manual reconciliation. They don’t match the speed or scale of a software-driven world.

Autonomous agents are now initiating transactions — retrieving data, renting compute, accessing APIs — and traditional payment systems are starting to break. Built for people, these systems rely on assumptions that no longer apply in a machine-driven world:

Users authenticate with emails, passwords, and account credentials

Payments are tied to delayed billing cycles and credit-based authorizations

Risk management depends on human-centric fraud detection and remediation

In contrast, AI agents are always-on, stateless, and increasingly autonomous. They interact with systems at a frequency and velocity that pushes legacy infrastructure beyond its design.

Analysts project that agentic AI will play a central role in digital commerce over the next decade:

33% of e-commerce enterprises are expected to integrate agentic AI by 2028, up from less than 1% in 2024, according to Gartner

35% of Amazon’s annual sales come from its AI-driven recommendation engine, showing AI’s direct commercial impact. (source)

80% of customer engagements are expected to be handled by AI-driven interactions by 2030, many leading to transactions. (source)

AI agents in e-commerce are projected to drive market growth from $3.6 billion in 2024 to $282.6 billion by 2034, a compound annual growth rate of 54.7% (source)

These trends show that agentic commerce isn’t just about backend automation — agents are beginning to drive real transactions, at scale, in production, and across every layer of the stack. With projections topping $1.7 trillion in transaction volume by 2030, the shift is impossible to ignore.

But today’s payment systems weren’t built for this. They assume human users, delayed billing, and manual fraud checks — assumptions that break down when software transacts autonomously. As more commerce is initiated by agents, the foundation of traditional payment infrastructure starts to erode.

This article outlines why today’s payments infrastructure isn’t built to support agent-driven transactions, what autonomous systems actually need, and how crypto-native protocols like x402 offer the right foundation for scalable, secure, real-time AI commerce.

Agent-driven transactions break old assumptions

Legacy payment infrastructure is designed around a few core ideas:

The user is a human with an email address and a credit card

Risk is managed through batch processing and chargebacks

Payment authorization is separate from service access

Transactions are occasional, not constant

Now imagine an agent trying to query multiple APIs, filter results, compare costs, and execute a paid action – all within seconds, without human approval.

A traditional invoice-based or credit-backed billing model won’t cut it – agents need to make real-time decisions and receive instant access, not wait for batch settlements or deferred invoicing.

Cloudflare, the largest DNS provider and one of the most widely used edge networks on the internet, recently announced a new pay-per-crawl billing model designed to support AI agents interacting with their web services. We're encouraged to see serious investment and product development in agentic commerce from a platform of their scale. Their approach, which settles payments retroactively on a human-linked card or invoice-based account, works well within their ecosystem and for enterprise customers already set up with billing agreements.

However, we see this as a short-term solution. It's a centralized model – similar in structure to how credit card companies operate – where a trusted intermediary coordinates access, usage, and payment reconciliation. While appropriate for controlled, enterprise environments, it becomes limiting in more open, composable agent networks.

Here’s where that model starts to break down:

Requires a persistent human billing relationship, which many agents won't have

Delays service authorization, adding latency or dependency for access

Introduces reconciliation complexity, especially when agents execute high-frequency transactions or act across domains

Enforces minimum payment sizes due to card network fee floors – which makes selling access to data or compute for less than around $0.30 uneconomical in many cases – due to fixed fee components in credit card processing (typically $0.05 to $0.15) combined with percentage-based fees that scale poorly on small transactions

Breaks down across borders for agents or developers not already within the Cloudflare billing network – FX conversion, cross-border settlement, and regulatory onboarding all introduce friction that crypto-native protocols can avoid entirely

Systems that depend on logins, accounts, or per-user billing relationships introduce friction that agents aren't designed to handle. And every workaround – from tokenization to prepay models to prepaid wallets – adds operational drag or new security risks that break down at machine scale.

What agentic payments actually need

Autonomous agents need a financial layer that is:

Deterministic: Payment and access should be atomic, not deferred

Low-latency: Millisecond response times, not batch settlements

Final: No chargebacks or reversals once payment is confirmed

Composable: Agents must be able to programmatically initiate and verify payment

Permissionless: No onboarding flow, no credential setup

Traditional card networks weren’t designed to support these requirements. Blockchain-powered payment rails, however, offer the architecture needed to meet them.

Crypto-native rails are purpose-built for this model

Using stablecoins (like USDC) on fast chains (like Base or other L2s), payments can settle in under 500ms, at a cost of less than $0.001. When paired with an open standard like x402, the flow becomes simple: the agent gets a 402 Payment Required response, signs and submits an onchain payment, and retries the request with proof of payment.

Crypto-native payment protocols eliminate the need for accounts, stored credentials, or centralized intermediaries. On the business side, they reduce overhead significantly, often by an order of magnitude compared to card networks, and eliminate chargeback risk entirely. This leads to lower operating friction and more predictable margins, especially in high-volume, low-value use cases. These systems are already in production today, working reliably across APIs, microservices, and even browser-based agents.

Just as importantly, crypto and AI speak the same language: software. Agents don’t need UI abstraction, onboarding flows, or credit card authorization – they need programmable money that can be moved through APIs, settled deterministically, and audited cryptographically.

This isn’t just about making payments faster or cheaper – it’s about aligning payment infrastructure with how autonomous agents operate and interact across the web.

Security must be designed for agent-native threats

Giving AI agents payment access introduces new classes of vulnerability. Unlike traditional apps, agents interpret instructions, hold memory, and reason probabilistically. That means they’re susceptible to manipulation in ways legacy clients are not.

Common threats include:

Prompt injection: Tricking an agent into taking action via crafted inputs

Memory manipulation: Modifying or implanting false memory state to trigger payments

Logic exploitation: Abusing natural language reasoning to override embedded guardrails

Over-permissioned agents: Where a compromised agent can trigger broad financial actions

Opaque reasoning: Making it difficult to audit why a transaction occurred

Securing agents means more than hardening the LLM. The payment layer must assume these risks and provide clear guardrails, audit logs, and cryptographic proof of authorization.

Tokenized fiat credentials don’t solve the core problems

Some providers have begun exposing tokenized card rails to agents. While this helps bridge the gap, it doesn’t address the fundamental limitations:

Tokens can be stolen or replayed

Post-paid billing still carries fraud risk

Authentication is often static and coarse-grained

Agents still rely on human-issued credentials

Tokenization may offer limited compatibility, but it still relies on infrastructure built for human-initiated, account-based transactions. It doesn’t solve for composability, automation, or scale in agent-native systems.

Why onchain is a stronger foundation

Of course, crypto-native infrastructure brings its own risks. Smart contract bugs, private key security, and blockchain transparency all require careful design. But the benefits are foundational:

Payments are final, not reversible

Access can be permissioned based on cryptographic proof

Transaction metadata is auditable, minimizing dispute complexity

Agents can hold and move value independently, without custodians

Systems like x402 abstract much of the underlying blockchain complexity. With proper tooling – client SDKs, dashboards, and wallet integration – developers can build secure, agent-friendly payment flows with minimal overhead.

Planning for a machine-native future

Agentic commerce is arriving faster than most billing systems can evolve. Developers are already building systems where payments are initiated, authorized, and settled directly by software agents – not humans. If your payment stack isn’t prepared for agent-native patterns, you’ll be forced into high-trust, high-maintenance workarounds that don’t scale.

Onchain payments aren’t theoretical. They solve a concrete infrastructure gap. They reduce fraud exposure, eliminate unnecessary reconciliation, and make atomic, real-time transactions viable for autonomous agents.

This isn’t about crypto for crypto’s sake. It’s about building infrastructure that matches how intelligent software will transact in the years ahead.

The tools to do this already exist – and they're being used in production today.

x402 is the open standard for machine-native payments. Explore the docs, try the demo, or integrate in minutes.