US Perpetual-Style Futures 101

by Coinbase Derivatives LLC

In this article, we’ll introduce US Perpetual-Style Futures – a new kind of futures contract that brings the benefits of international perpetual futures to a US regulated market. We’ll break down the key components, how these contracts work, and how they compare to traditional futures contracts.

What are US Perpetual-Style Futures?

US Perpetual-Style Futures are a new kind of futures contract offered by Coinbase Derivatives.

They are long-dated futures contracts (five year expirations) that closely track the underlying asset’s spot price.

These contracts trade 24/7 and are designed to bring the core benefits of international perpetual futures to a US-regulated environment.

Background

International perpetual futures allow traders to speculate on the price of an asset without an expiration date, while closely tracking the asset’s spot price.

They are largely unavailable in the US due to regulatory restrictions but are widely traded internationally.

Perpetual futures represent more than 90% of global crypto derivatives volume. Major exchanges operating outside of the US have consistently reported daily trading volumes exceeding $50 billion for perpetual futures.

Demand for this product in the US is strong. Some US-based traders access perpetual futures through offshore exchanges, an approach that introduces regulatory, custody, and counterparty risks.

US Perpetual-Style Futures eliminate the need for offshore workarounds, offering traders a domestic, regulated alternative with the same utility.

How do US Perpetual-Style Futures work?

US Perpetual-Style Futures are designed as long-dated futures contracts (5 year expirations) with 24/7 trading.

The contracts incorporate a funding rate mechanism to keep futures prices closely aligned with underlying spot markets:

Funding accrues hourly and is settled twice daily during designated cash adjustment periods.

At each settlement period, accrued funding is aggregated and credited or debited to traders' accounts.

These mechanics enable a spot-like trading experience with the advantages of leveraged futures tax treatment.

US Perpetual-Style Futures have set contract sizes. For example, each nano Bitcoin Perpetual-Style Futures contract represents 1/100th of a Bitcoin.

This differs from international perpetual futures, where investors can enter positions for any amount above the minimum - there are no set contract sizes.

US Perpetual-Style Futures additionally offer up to 10x intraday leverage, enabling traders to amplify their exposure with limited capital.

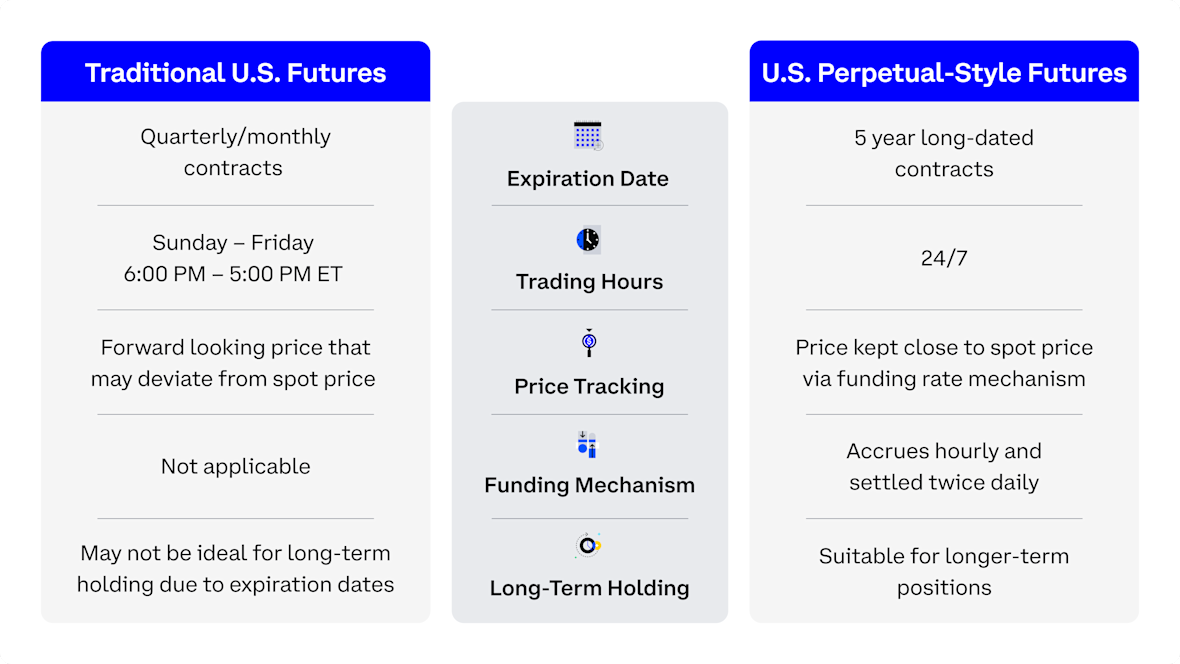

How are these contracts different from traditional futures contracts?

US Perpetual-Style Futures are designed to function like global perpetual futures.

In traditional futures markets, contracts have monthly or quarterly expirations. Traders must either close their position or roll it into a new contract before it expires.

This creates operational complexity, especially for longer-term strategies. US Perpetual-Style Futures have five year expirations, making it easier for traders to hold positions without needing to roll.

US Perpetual-Style Futures additionally offer traders a way to track price movements 24/7 by closely mirroring spot prices through a funding rate mechanism.

Traditional futures contracts have forward looking prices that may deviate from spot prices.

By combining long-dated contracts with a funding mechanism, US Perpetual-Style Futures offer a "spot-like" trading experience while retaining all the features traders expect from derivatives—such as leverage and risk management.

Trading example

An investor enters a long position in 1 nano Bitcoin Perpetual-Style Future (BIP) at a price of $100,000 at 1:30 PM ET. The trader holds the contract through the 2:00 PM ET funding period and sells it at a price of $101,000 at 2:30 PM ET.

At the 2:00 PM ET funding period, the funding rate for the hour is +0.010% and the mark price for the hour is $100,000. A funding debit of $1.00 (1 contract × 0.01 contract size × $100,000 mark price × 0.010% funding rate) is accrued for this hour.

At the end of day, the final funding debit or credit is calculated using the latest mark price, and all accrued funding payments are processed.

Investors can trade our US Perpetual-Style Futures on our partner platforms now.

Recap

Key terms

US Perpetual-Style Future

A type of long-dated futures contract offered by Coinbase Derivatives that closely tracks the underlying asset’s spot price.

Perpetual future

A type of futures contract tradeable internationally without a fixed expiration date that closely tracks the underlying asset’s spot price.

Funding rate

A periodic payment between long and short positions designed to keep futures prices aligned with spot markets.

Leverage

The ability to control a large position with a relatively small amount of capital (margin).

Margin

The deposit required to open and maintain a position in a futures contract.

Mark price

A calculated reference price that represents the estimated fair value of a futures contract.

The risk of loss in trading futures can be substantial. You should, therefore, carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.