How 24/7 trading works at Coinbase Derivatives

by Coinbase Derivatives LLC

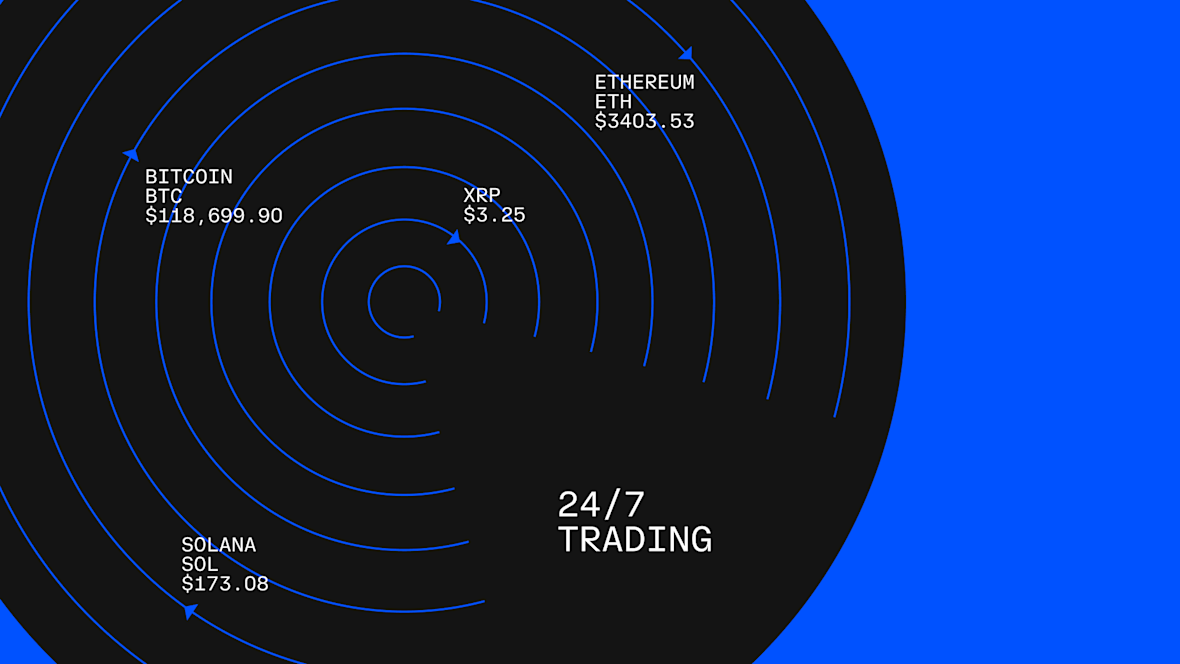

On May 9, 2025, Coinbase Derivatives became the first CFTC-regulated derivatives exchange to offer 24/7 trading for margined futures contracts. In this article, we’ll break down what 24/7 trading means at Coinbase Derivatives, how it works, and why it matters for traders.

Background

At Coinbase Derivatives, futures trading has traditionally been available Sunday – Friday 6:00 PM – 5:00 PM ET, aligning with established industry norms.

Weekend trading was inaccessible, creating a disconnect between US markets and the always-on nature of crypto trading.

Coinbase Derivatives became the first CFTC-regulated derivatives exchange to offer 24/7 trading with our initial launch of nano and institutional-sized Bitcoin and Ethereum futures.

This launch expanded market access for US traders to manage risk and seize opportunities in real time, no longer forcing traders to sit on the sidelines during key market moves.

How does 24/7 trading work at Coinbase Derivatives?

Coinbase Derivatives now offers 24/7 trading for several futures contracts. These contracts trade Friday 6:00 PM – Friday 5:00 PM ET with a one-hour weekly maintenance period on Fridays from 5pm - 6pm ET.

All weekend trading activity from Friday evening through Sunday evening will be attributed to Monday’s trade date. This structure ensures that weekend activity is processed within a single business day for clearing, settlement, and regulatory reporting.

The approach aligns with established industry conventions—such as those used during US market holidays—and enhances operational efficiency.

All trades are cleared through Nodal Clear, a CFTC-regulated derivatives clearing organization, ensuring consistent transparency and compliance within and outside of traditional trading hours.

Coinbase Derivatives partners with experienced market makers to help maintain consistent liquidity, enabling tighter spreads, more efficient pricing, and an overall better trading experience.

Several FCMs now provide seamless market access to these 24/7 products:

What contracts are available to trade 24/7?

Coinbase Derivatives offers a number of traditional futures contracts with 24/7 trading capabilities.

Contracts include:

Additionally, Coinbase Derivatives has launched US Perpetual-Style Futures. They are long-dated futures contracts with 24/7 trading capabilities that track the underlying asset’s spot price.

Contracts include:

Visit our website to learn more about our latest perpetual-style contracts available for 24/7 trading.

Recap

Key terms

US Perpetual-Style Future

A type of long-dated futures contract offered by Coinbase Derivatives that closely tracks the underlying asset’s spot price.

Commodity Futures Trading Commission (CFTC)

An agency of the US government that regulates derivatives markets.

nano Contracts

Smaller-sized futures contracts designed to offer greater accessibility, particularly for retail traders.

Nodal Clear

A CFTC-regulated clearinghouse responsible for clearing trades executed on Coinbase Derivatives.

FCM (Futures Commission Merchant)

A CFTC-regulated intermediary that facilitates client access to futures markets, including execution and custody services.

Market Makers

Professional trading firms that provide liquidity by continuously quoting buy and sell prices, helping to ensure tight spreads and efficient pricing.

The risk of loss in trading futures can be substantial. You should, therefore, carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.