BTC hits lowest level since Nov. 2024

There’s never a dull moment onchain. Here’s what you need to know this week:

Bitcoin hit its lowest level since Trump’s election. Also, how BTC ETF holders and Strategy are faring amid the current market downturn.

What’s on the horizon for crypto markets? Breaking down the bull case, bear case, and what could be next for altcoins.

SpaceX’s current bitcoin holdings. And more key stats from around the cryptoverse.

MARKET BYTES

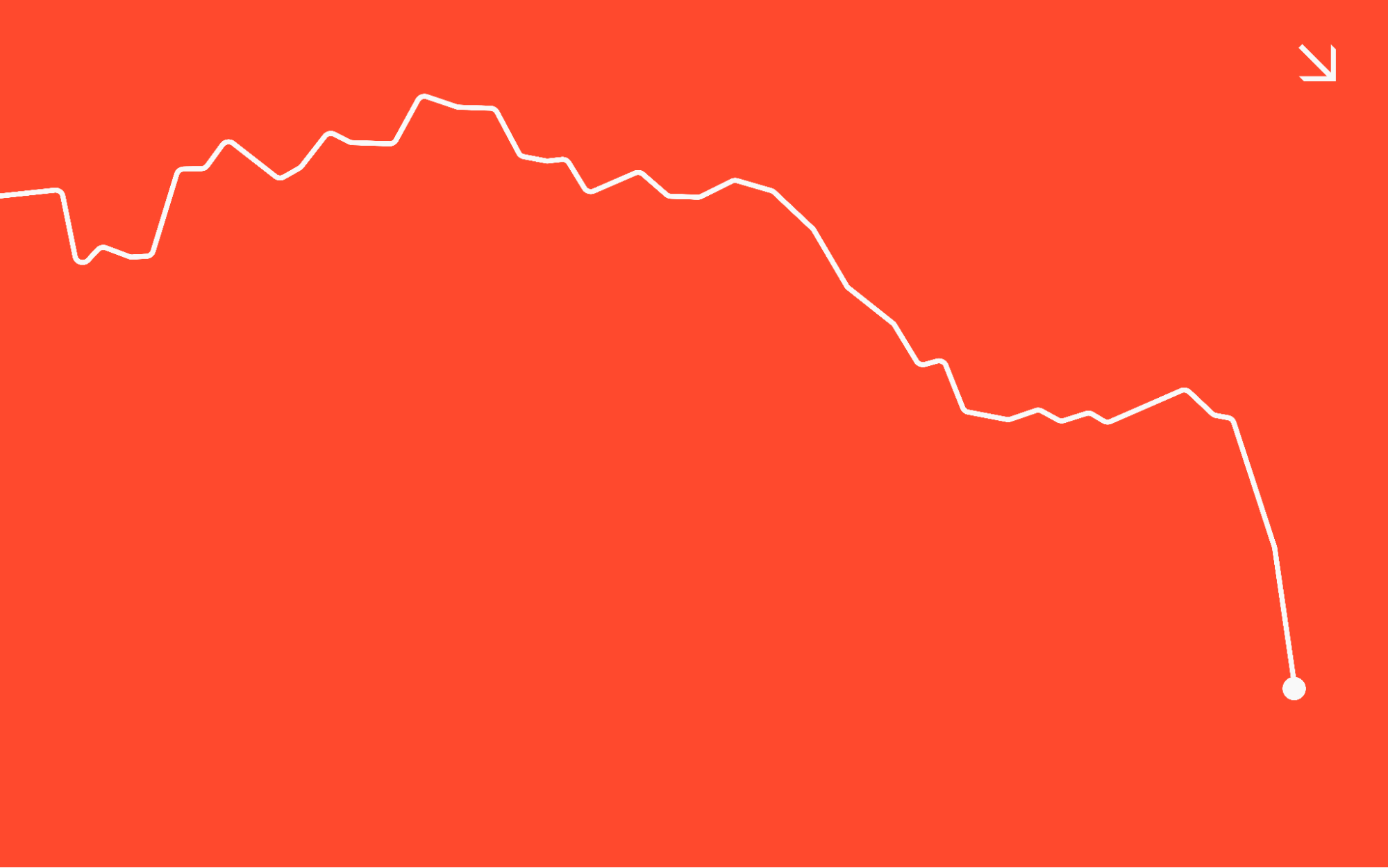

Bitcoin fell below $73k, its lowest level since 2024

Bitcoin, ether, and the broader crypto market all saw major declines over the weekend and into this week. On Tuesday, BTC fell below $73,000, the lowest price since President Trump’s election in November of 2024 and more than 40% shy of the all-time high of $126,000 set in October.

“A sharp escalation in U.S.-Iran tensions, a surging dollar after Kevin Warsh's Fed nomination, and cascading forced liquidations have driven a broad sell-off across crypto, gold, silver and U.S. stock futures,” noted CoinDesk. (More on why markets are sliding, and what might happen next, in our main story.)

Altogether, cryptocurrencies have lost roughly $1.7 trillion in market value, or about 39% from last year's peak, according to 10X Research.

After trading as low as $72,867 on Tuesday, prices began to rebound after the House of Representatives passed a funding package to head off another U.S. government shutdown.

Here’s more news you need to know…

On average, BTC ETF holders are now in the red

Before the recent downturn, one of the major factors driving crypto prices to repeated all-time highs was the explosive growth of crypto exchange-traded funds (ETFs).

Such ETFs buy crypto and sell shares via conventional stock markets, and they’ve brought billions of dollars of new capital into the digital economy. But over the course of February, as prices ticked downward, BTC ETFs shed around $1.6 billion.

Now, according to Glassnode data cited by Bloomberg, “buyers who entered the market via US spot-Bitcoin exchange-traded funds paid an average of about $84,100 per coin. With Bitcoin now trading near $78,500, the group is sitting on average paper losses of roughly 8% to 9%.”

Bright spot… On Monday, BTC ETFs notched $561.9 million in net inflows, the biggest day in a few weeks. And even after recent losses, BTC ETFs as a category still held around $107 billion in bitcoin as of Monday. Or, as Bloomberg put it, “a notable foothold for an ETF segment that didn’t exist in the US two years ago, and one that still includes a base of long-term, patient capital.”

With Strategy’s BTC underwater, what might happen next?

Just before the weekend dip, the bitcoin-accumulating behemoth Strategy bought another 855 bitcoin for $75.3 million, putting its total stash at 713,502 bitcoin, purchased at an average price of $76,052 each.

With BTC trading around $73,500 on Wednesday, that puts the firm previously known as MicroStrategy underwater on its holdings. Strategy’s stock, which was one of the fastest rising on Wall Street six months ago, is down more than 67% since then.

So, what does that mean for the company’s future? In the short term, not much besides limiting its ability to raise capital to purchase more BTC, according to CoinDesk: “Strategy currently holds 712,647 bitcoin — all of it unencumbered, meaning none of the holdings are pledged as collateral, so there's no risk of forced selling just because the price falls below its cost of buying.”

Lever effect… Why is Strategy down more than 60% since BTC’s early October peak while bitcoin itself is down only around 40%? In part because Strategy uses leverage, which amplifies gains when prices are rising and losses when they’re falling.

CRYPTO CROSSROADS

What’s on the horizon for crypto markets?

Back in early October, crypto HODLers were celebrating as bitcoin hit an all-time high north of $126,000.

But just a few days later, on October 10, around $19 billion in leveraged BTC bets were liquidated almost overnight. Ever since, crypto markets have struggled to regain momentum.

This weekend, another major dip brought prices below where they were back in November 2024, when the election of the most pro-crypto government in U.S. history kicked off a sustained rally.

So, where are we now and what might happen next? Let’s dig into what market watchers are saying.

What triggered the most recent dip?

There’s no one single factor contributing to crypto’s most recent bout of weakness, but most market watchers agree about some of the factors at play.

Markets of all kinds, including stocks and precious metals (which often trade in opposite directions) have seen increased volatility this week, as traders weighed the impacts of a partial U.S. government shutdown; the newly announced Federal Reserve chair, and rising geopolitical tensions, among other key factors.

Because crypto trades 24/7, it can react to news that breaks while traditional markets are closed. Weekend trading, meanwhile, is also defined by thinner liquidity conditions than normal, meaning that there are fewer buyers and sellers participating in the market.

The result? Prices can often see volatility.

Additionally, liquidity in the crypto market has been thinner than usual since Oct. 10. “The market has faced persistent downward pressure since the October selloff,” Bloomberg notes. “Investor concerns have remained elevated amid economic headwinds, while stocks have struggled to rebound amid low risk appetite and persistent AI bubble fears.”

What’s the case for prices continuing to drop?

The Fear & Greed Index is currently in “Extreme Fear,” indicating that investors are worried about crypto’s price decline continuing.

Some analysts suggest that bitcoin could be mired in a prolonged bearish phase, with lower prices than this week’s potentially on the horizon.

“It’s been my view since [the] end of October that BTC is in a sideways and downside phase,” said Eric Crown, a former options trader at NYSE Arca. “I do not think 80K is a macro low for bitcoin.”

Markets seem to agree. BTC options traders have bet billions on BTC falling below $75,000. And after more than a year of bullish options trades dominating the market, there is now an almost equivalent amount of money placed on bitcoin falling below $70,000 as there is for bitcoin reaching $100,000.

"This is not a 'bull market correction' or 'a dip,' said BitWise CIO Matt Hougan. "It is a full-bore, 2022-like, Leonardo-DiCaprio-in-The-Revenant-style crypto winter."

What’s the case for prices recovering soon?

Hougan, among other market watchers, is actually fairly optimistic about what comes next. He suggests that we could already be close to (if not at) the bottom — meaning that the recovery phase could begin within a few weeks.

A new report from analysts at Compass Point made a similar argument: “While near-term risk remains skewed to the downside, we believe we're approaching the final innings of the crypto bear market,” the report said, with expectations for bitcoin to begin to reverse course between $60,000-$68,000.

Analysts from Bernstein echoed the same sentiment, saying they believe bitcoin will be "bottoming out around its last cycle highs ~60K range," within the coming months.

And David Duong, the head of research at Coinbase, maintained last week that his outlook for the rest of Q1 was “constructive.” While the impacts of the Oct. 10 crash are still lingering and geopolitical tensions loom, he noted strong GDP growth, two potential U.S. interest rate cuts in 2026, and stabilizing inflation could be a boon for crypto.

Institutional investors also share Duong’s view, at least on bitcoin, with 70% of respondents to a recent Coinbase survey saying they believe bitcoin is currently undervalued.

What will happen to ETH and altcoins?

As bitcoin goes, the rest of crypto generally follows. It’s unlikely that there will be a major recovery for Ethereum and other altcoins until bitcoin finds its footing.

As of Monday, ETH had declined by more than 20% for the week and TOTAL2, which tracks the market cap of all cryptocurrencies outside of bitcoin, was down by 12%.

Still, there are some small signs of hope, particularly among altcoin ETFs. While spot Ethereum ETFs saw more than $350 million in outflows last month, spot Solana ETFs saw approximately $105 million in net inflows. And spot XRP ETFs also saw $16 million net inflows in January.

NUMBERS TO KNOW

$6.2 billion

The market cap for tokenized gold tokens, as of Tuesday. Amid gold’s rally to new all-time highs in price, investors have flocked to tokens like PAXG, which represent digital ownership over physical gold locked in vaults.

$17.5 billion

The combined trading volume in January on the prediction market platforms Kalshi and Polymarket, up from around $2 billion in August, according to The Block. Sports-related contracts have been a leading driver, accounting for at least 80% of Kalshi’s daily trading volume.

$650 million

The amount in bitcoin held by SpaceX. The company, owned by Elon Musk, recently merged with xAI, another Musk owned entity. SpaceX initially disclosed its bitcoin purchases in 2021.

TUNE IN

Listen to the new season of “Evolving Money”

Season 3 of “Evolving Money,” Coinbase’s award-winning podcast produced in conjunction with Bloomberg Media Studios, kicks off next week with an episode looking at a top trend in crypto: tokenization.

In less than three years, the amount of tokenized real-world assets has grown eightfold, to more than $30 billion across equities, fixed income, private assets, real estate and more.

Tune in next week on Spotify, Apple, or wherever you get your podcasts. In the meantime, you can check out seasons 1 & 2.

TOKEN TRIVIA

What is dollar cost averaging?

A

A gradual investment strategy that does not rely on “timing the market”

B

A method to automate crypto purchases on Coinbase

C

A way to invest any amount of money at regular intervals of time

D

All of the above

Find the answer below.

Trivia Answer

D

All of the above

Coinbase Bytes

Your weekly digest of crypto news

Learn how we collect your information by visiting our Privacy Policy