About dFund

dFund is a project that aims to build an all-encompassing platform combining advanced DeFi smart-contract-powered features including decentralized hedge funds, direct p2p lending, credit scores, DAO governance and a secondary marketplace for synthetic assets into one easy to use platform. Every user on the platform will be able to start their own decentralized hedge fund, or invest in one, and decentralized hedge funds on the platform will be ranked by their performance (roi), so people can make informed decisions. The founder of the decentralized hedge fund can only swap / trade with user funds, while withdrawals and payouts are automated by smart contracts, therefore eliminating the possibility of scam or pyramid schemes. The platform will also enable users to participate in direct p2p lending, where every user sets the loan amount, interest rate, loan duration, and collateral requirement, which can be even under or over 100% allowing for under and over collateralized loans. Every borrower on the platform will have a credit rating, and lenders can set the minimum credit rating required to take the loan, and even set different collateral requirements and interest rates for users with different credit ratings. If someone never got liquidated on their loan aka never defaulted and always paid back the loan amount + interest on time, they will have a very high credit rating, while users who get liquidated / default many times will see their credit rating slip down. Credit rating can be improved or worsened over time. The platform will also have a secondary marketplace for synthetic assets where users can buy and sell the loans, therefore allowing lenders to exit their positions and delegate the risk and waiting time to other users. So for example, if a user is lending a loan with a 10% interest rate, but they need money / liquidity urgently or they simply don’t want to wait until the end of the loan duration, they can instead decide to sell their loan, and maybe someone will buy it for 4% instantly, which would mean a 6% profit for them after they receive the original 10% interest at the end of the loan’s duration, which is beneficial for both a buyer and the seller. For the seller (the original lender), they don’t have to wait and they are getting a smaller profit with no risk, and for the buyer of the loan, they are receiving a higher profit for waiting until the end of the loan’s duration. This is in many ways similar to real life bond market.

Market Stats

Market Cap

$6.87K

FDV

$20.65K

Circ. Supply

332M DFND

Max Supply

1B DFND

Total Supply

1B DFND

Diluted Valuation

$167.03K

Performance

Popularity

Not enough data

Dominance

0%

Volume (24H)

$8.89

Volume (7D)

Not enough data

Volume (30D)

Not enough data

All time high

$0.0538

Price Change (1Y)

Not enough data

93.29%

Additional details

Market details

DFND vs markets

↘ 90.55%

DFND vs BTC

↘ 90.15%

DFND vs ETH

↘ 90.58%

Tags

Network & Addresses

Network | Address | |

|---|---|---|

Ethereum | 0xd2adC1C84443Ad06f0017aDCa346Bd9b6fc52CaB |

Price history

Time | Price | Change |

|---|---|---|

Today | $0.000021 | |

1 Day | $0.000021 | |

1 Week | $0.000021 | |

1 Month | $0.000120 | |

1 Year | $0.000308 |

FAQ

dFund calculator

Related assets

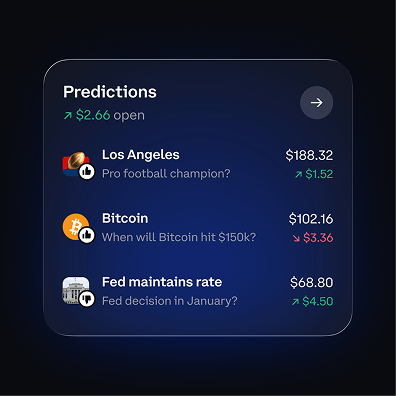

Popular prediction markets

Cryptocurrencies with similar market cap

Legal

Information is provided for informational purposes only and is not investment advice. This is not a recommendation to buy or sell a particular digital asset or to employ a particular investment strategy. Coinbase makes no representation on the accuracy, suitability, or validity of any information provided or for a particular asset.

Certain content has been prepared by third parties not affiliated with Coinbase Inc. or any of its affiliates and Coinbase is not responsible for such content. Coinbase is not liable for any errors or delays in content, or for any actions taken in reliance on any content. Information is provided for informational purposes only and is not investment advice. This is not a recommendation to buy or sell a particular digital asset or to employ a particular investment strategy. Coinbase makes no representation on the accuracy, suitability, or validity of any information provided or for a particular asset. Prices shown are for illustrative purposes only. Actual cryptocurrency prices and associated stats may vary. Data presented may reflect assets traded on Coinbase’s exchange and select other cryptocurrency exchanges.