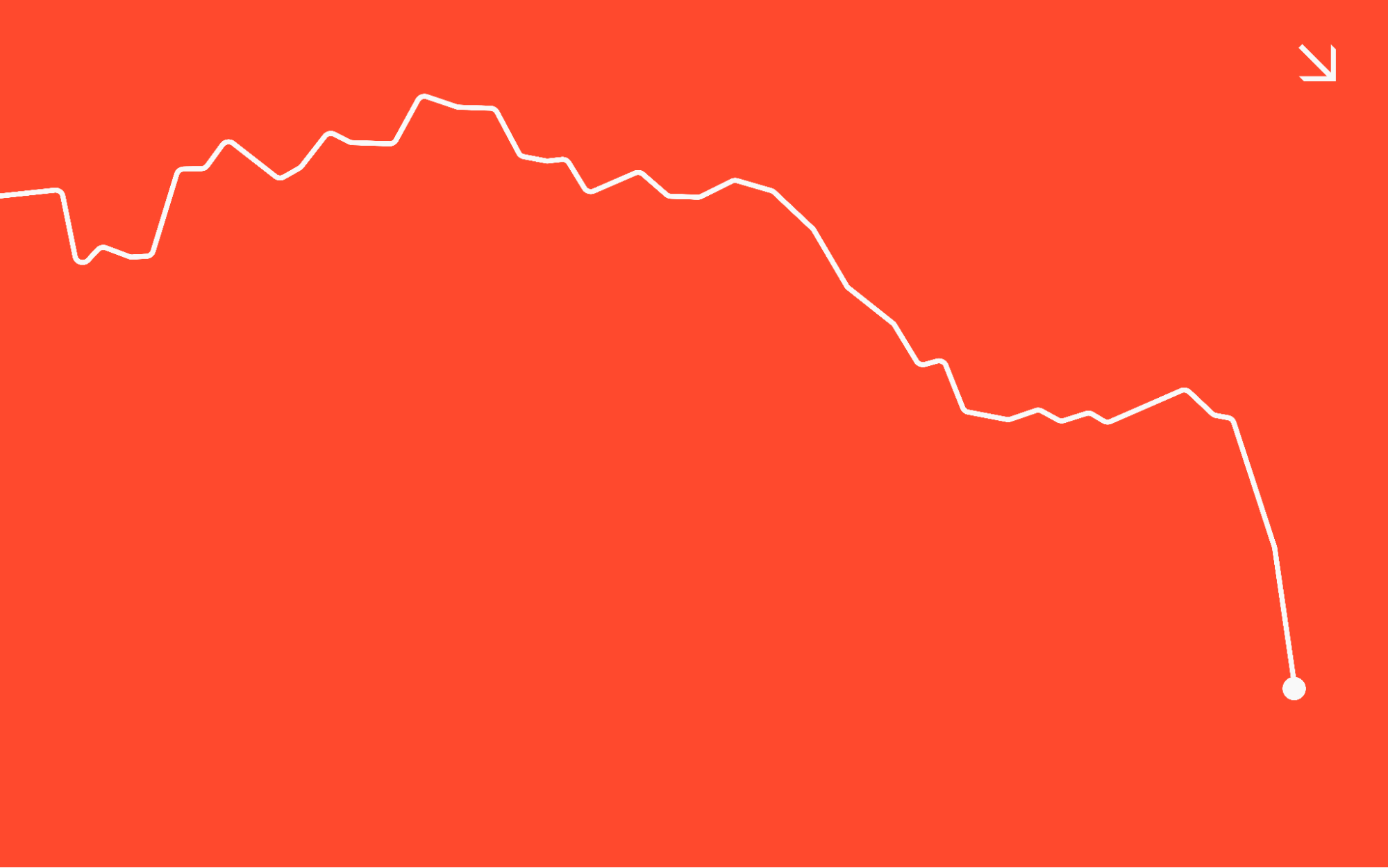

Bitcoin volatility continued this week

There’s never a dull moment onchain. Here’s what you need to know this week:

Bitcoin bounced back above $70K before dipping again. Meanwhile, major crypto ETFs saw inflows return.

5 theories why BTC has been struggling. From profit taking to alternative investments, top analysts weigh in.

The number of ETH that Bitmine acquired last week. And more key stats from around the cryptoverse.

MARKET BYTES

Bitcoin bounced back above $70K before dipping again

After falling to just above $60,000 last Thursday — down from a peak north of $126,000 in October — bitcoin rebounded to around $70,000 on Monday and held to a range just above and below that figure through Tuesday.

By Wednesday, however, volatility returned, with BTC zigzagging between $66,000 and $69,000.

The week offered some hopeful signs. Trade volume, or the amount of BTC bought or sold, has been relatively low, potentially signalling that many day-to-day retail traders are continuing to HODL. And, according to Decrypt, some of the largest crypto whales have begun to buy the dip.

But analysts remain uncertain about where things will head next. “From the perspective of price action and on-chain distribution, the pace of the decline is indeed decelerating,” Tim Sun, senior researcher at HashKey Group, told Decrypt. “However, we have yet to see a signal for a definitive trend reversal.”

Here’s more news you need to know.

What do market watchers think will happen next?

Major analysts are split on where Bitcoin could be headed. “Bitcoin is currently caught in a high-stakes tug-of-war between technical gravity and a potential institutional ‘pain trade,’” as Decrypt put it,

One argument suggests that rising prices will run into a huge cohort of traders in futures markets that have bet that prices will continue to fall, resulting in mass liquidations of their positions, driving prices even further upward.

Another argument suggests that the macroeconomic picture is stacked against BTC for the time being, which could result in prices dipping even further.

What do predictions markets say? As of Tuesday, Kalshi traders were predicting BTC at $69,500 or higher by Friday evening. And on Polymarket, a majority of traders believed BTC will rise past $75,000 by the end of the month.

Major crypto ETFs saw inflows return

Crypto ETFs, which helped drive prices to new highs last year, have struggled since prices began to slide in October.

“Investors have pulled $3.2 billion from Ether ETFs, with $462 million withdrawn just this year,” reports Bloomberg. “Bitcoin ETFs, meanwhile, have seen $7.9 billion in outflows in the same period, with $1.8 billion of that pulled this year.”

But as prices began to tick up, crypto ETFs also shifted positive, with ETFs holding BTC, ETH, and XRP all seeing net inflows on Monday, according to CoinShares’ latest report.

Steady ships… Even with the capital pulled out during the downturn, BTC ETFs remain massive. “According to Checkonchain, the cumulative [assets under management] of the 11 funds has only decreased by about 7% since early October, sliding from 1.37 million BTC to 1.29 million BTC,” noted CoinDesk.

TAKES

What’s behind bitcoin’s downtrend? Five theories from top analysts

Bitcoin is in its worst price slump in years, and analysts are split on exactly why.

Some say it's due to investors taking profits after massive gains; others point to prediction markets and AI drawing attention away from crypto. “There’s no smoking gun,” as Mike Novogratz, the CEO of Galaxy Digital, put it.

Despite the uncertainty, a number of analysts are still maintaining a bullish outlook for 2026.

Here are some of the prevailing theories for why bitcoin has struggled recently.

1. Investors were eager to lock in gains after the “euphoria” of Trump’s election, argued Novogratz. Matt Hougan, the CIO of Bitwise, agreed with this view, writing in a recent note that “widespread profit-taking by OGs” was a contributing factor to bitcoin’s recent weakness.

After bitcoin rose 80% between Trump’s election in November 2024 and mid-October of 2025, and Ethereum more than doubled over a similar span, profit taking was a likely outcome, especially for longer-term holders who were heavily in profit.

2. “Many financial firms are hesitant to integrate digital assets into their offerings” without the passage of the CLARITY Act, said the Wall Street Journal in a recent article. The law aims to create a clear regulatory framework for the crypto industry, but the legislation is currently at an impasse, which could “deny the crypto market a catalyst that could have extended the rally,” said the Journal.

3. Bitcoin’s price decline “reflects a retreat from highly speculative gains over the past two years,” said analysts at Deutsche Bank. The current market phase doesn’t represent a full-on collapse, argued the bank’s analysts, but rather a reset that will test whether bitcoin can see gains due to true adoption instead of speculation and hype from retail investors.

The bank’s analysts added that retail interest is fading, with their surveys showing U.S. consumer crypto adoption has slipped from 17% in mid-2025 to around 12%. And amid macroeconomic fears and geopolitical turbulence, bitcoin hasn’t lived up to its “digital gold” moniker as it has declined for four straight months while gold is up around 15% since the start of 2026.

4. There are now “many other areas where people can go and they can speculate,” said Anthony Pompliano, the CEO of ProCap Financial. For years, crypto was seen as the best way to make an audacious bet for potentially massive upside — “the consensus view where asymmetry existed,” as Pompliano put it. But as AI, precious metals, and prediction markets gain in popularity, crypto is suddenly competing for attention and capital.

AI startups received more than $202 billion in venture capital funding last year — nearly half of all venture funding doled out globally. Prediction markets are now garnering billions of dollars per week in trading volume, up from just $7 million less than two years ago. And many bitcoin miners are increasingly “pivoting to AI” and using their facilities to provide computing power for AI models, with some even selling bitcoin to do so.

5. This is a “self-imposed crisis of confidence,” according to Bernstein analysts. While some analysts increasingly warn about a larger crypto bear market approaching, Bernstein’s analysts maintain a bullish outlook for 2026, saying “what we are experiencing is the weakest bitcoin bear case in its history.”

Without any systemic breakdowns or exchange collapses — “nothing blew up, no skeletons will unravel” — the firm’s analysts maintain that the recent downturn doesn't reflect the fact that institutional alignment remains strong; U.S. policy is still pro-crypto, and many large fund managers are increasingly stepping into crypto markets. The report reiterated a $150,000 price target for bitcoin by the end of 2026.

NUMBERS TO KNOW

$23 billion

The amount in gold that stablecoin issuer Tether currently owns. In recent months, the firm’s gold-buying has outpaced most global central banks and its holdings place it in the top 30 of gold-holders globally, ahead of countries like Australia, the United Arab Emirates, and South Korea.

100,000

Number of times more powerful that quantum computers would have to become to challenge bitcoin's encryption, according to a new report from CoinShares.

40,613

Number of ETH that Ethereum treasury firm Bitmine acquired last week as prices were falling. “Bitmine Immersion Technologies said it now controls $10 billion in crypto, equities and cash after adding more ether during last week's crash,” reported CoinDesk.

TUNE IN

Check out the new episodes of “Evolving Money”

The latest episodes of our award-winning podcast, “Evolving Money,” are out now. This week’s show is all about the ways that big TradFi institutions are integrating crypto into their investment offerings. And last week we did a deep dive on one of the biggest trends disrupting financial markets: tokenization.

Listen today on Spotify, Apple, or wherever you get your podcasts.

TOKEN TRIVIA

What is mining?

A

A proof-of-stake consensus mechanism

B

The process Ethereum uses to generate new coins and verify transactions

C

The process Bitcoin uses to generate new coins and verify transactions

D

All of the above

Find the answer below.

Trivia Answer

C

The process Bitcoin uses to generate new coins and verify transactions

Coinbase Bytes

Your weekly digest of crypto news

Learn how we collect your information by visiting our Privacy Policy